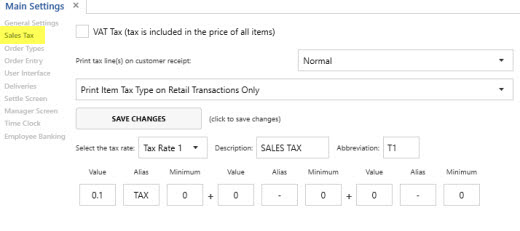

AmigoPOS includes support for most municipalities sales tax requirements. Sales tax preferences are entered in Back Office | Settings | Main Settings by clicking the Tax Rates tab.

Main Settings/Sales Tax

Up to 4 tax rate definitions can be created (in addition to Tax Rate 5 which is reserved for non-taxable items). Most users will have a single tax rate definition with one or two components. Each tax rate component corresponds to the portion of the tax paid to a municipality or other tax collection agency. Refer to the sales tax full size report to determine if separate tax rate components are required for your municipality.

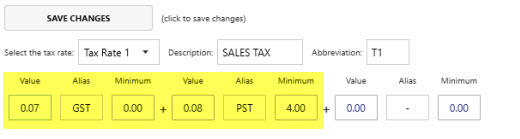

For example, users in Ontario, Canada should define two components, one for the federal Goods and Services Tax (GST) of 5% and one for the Ontario provincial sales tax (PST) of 8% as shown below. Note that the PST will only be applied when the order subtotal is more than $4, as defined by the Minimum value next to PST. The values for Tax Rate 2 through Tax Rate 4 are shown for reference only. Generally only Tax Rate 1 is needed for food service establishments. Note that users in Ontario must define an additional tax rate for alcoholic beverages, where the PST is charged regardless of the order subtotal.

Sample tax configuration for users in Ontario, Canada

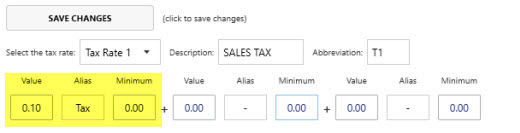

In many areas, users may require only a single tax component, as shown below. Note that all values are set to zero except for the first component of Tax Rate 1.

Sample tax configuration

Value Added Tax (Inclusive)

Users in countries such as Australia where tax is included in the price of the item should check the box next to VAT TAX and enter the correct tax rates. This ensures that tax reports are accurate. Note that VAT Tax inclusive is different from Non-Taxable and should not be used in areas where the tax is not already included in the price of the item.

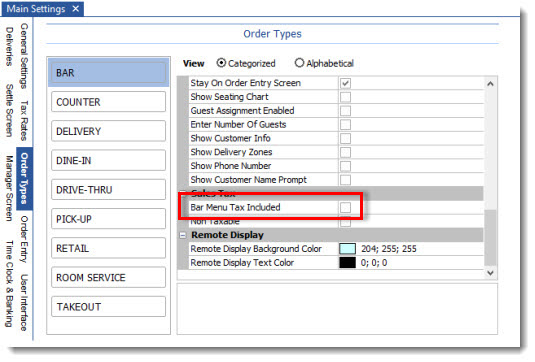

Special Case: Tax Included for Bar Menu Items Ordered at the Bar

Use this setting only when the tax settings are not VAT (value added tax) and bar menu items ordered at the bar have tax included in the price

In some environments, tax is added to the price of bar menu items when the customer is seated in the dining room, but tax is included in the price of the bar menu item when the customer is seated at the bar. To enable this feature, navigate to Back Office | Settings | Main Settings Order Types and check the box under the Bar Menu Tax Included column next to the order type used at the bar, as shown below. Note that this setting affects bar menu items and bar menu item modifiers only. Regular menu, pizza and retail items are taxed normally.

In the example below, bar items ordered for the Bar order type are considered tax-included, but tax is added to bar menu items ordered when using any other order type. For example, a beer that costs $3.00 ($2.78 + .22 tax) at the bar will cost $3.24 when ordered at the dining room (at 8% tax rate).

Specific Order Type Tax-Inclusive Bar Menu Items

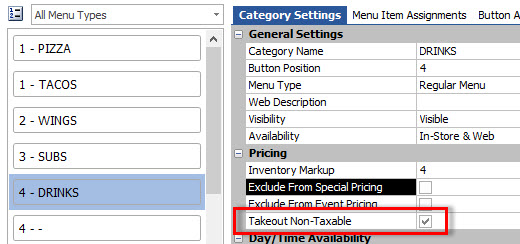

Non-Taxable Menu Categories For Takeout

Some locations may charge tax on food for dine-in orders but not takeout orders, while always charging tax on drinks regardless of order type. In order to specify that tax should not be charged for takeout orders, open the menu category editor and check the box next to Takeout Non-Taxable for any menu category that is tax exempt for takeout orders. In addition, verify that the order type is set to charge for takeout containers (even if the container charge is 0), as described in the Order Types topic.

Menu Category Editor