The transaction types listed below are available when Datacap NETePay integrated credit card processing interface.

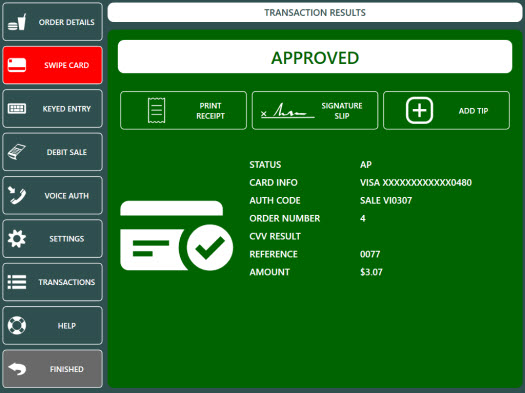

The SALE transaction type is used to process a payment on a credit card (VISA, MasterCard, American Express, Discover, Carte Blanche, Diner's Club, JCB or other supported card type). An approved sale transaction is added to the batch and will be settled at the next scheduled batch settlement and can be adjusted to add a tip before the batch is settled.

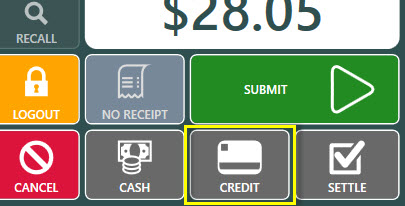

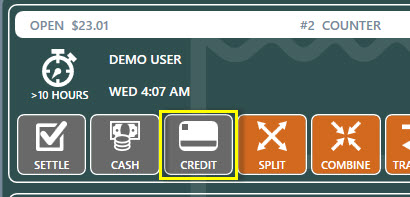

The SALE transaction can be initiated directly from the order entry screen, the order recall list or the settle screen.

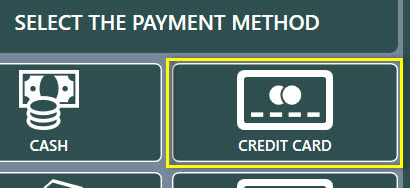

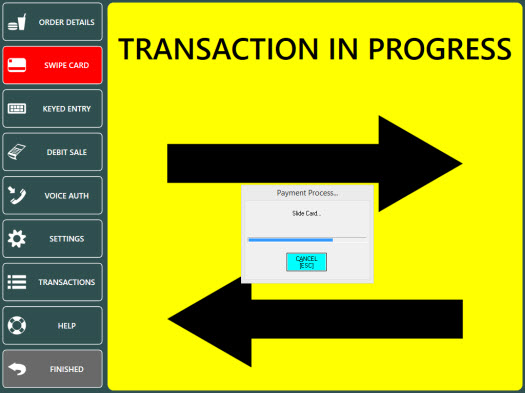

Press the CREDIT button to automatically initialize the card reader and display the card swipe prompt.

The transaction is canceled if the card is not swiped within 20 seconds.

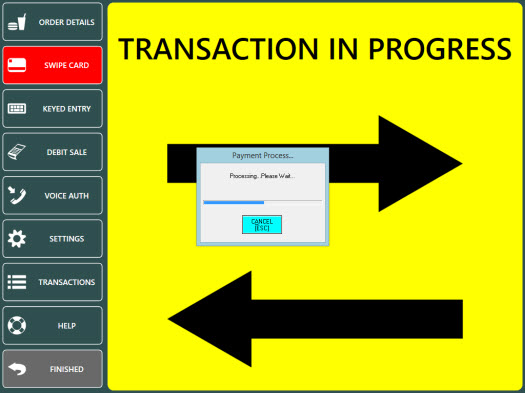

The transaction is sent to the server. The "Processing...Please Wait" prompt is displayed until a response is received from the payment processor, generally in 3-5 seconds.

A green background indicates a successful transaction.

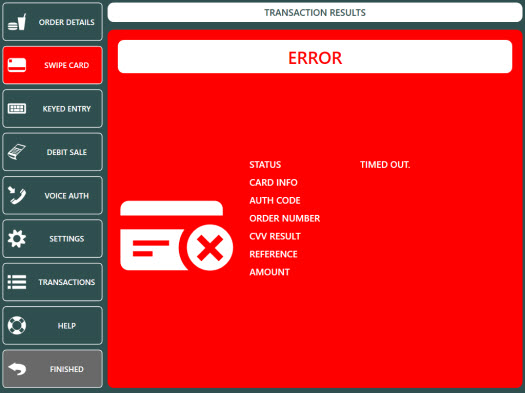

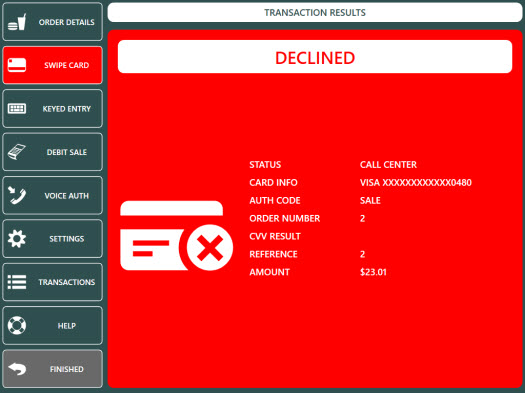

A red background indicates a declined transaction or transaction error. The CALL CENTER message displayed below indicates that the cashier must call the payment processor to provide additional information before the transaction can be approved.

Debit card transactions require a compatible pinpad. Note that the ADD TIP transaction is not available for debit card transactions. An approved debit card transaction is added to the batch and will be settled at the next scheduled batch settlement.

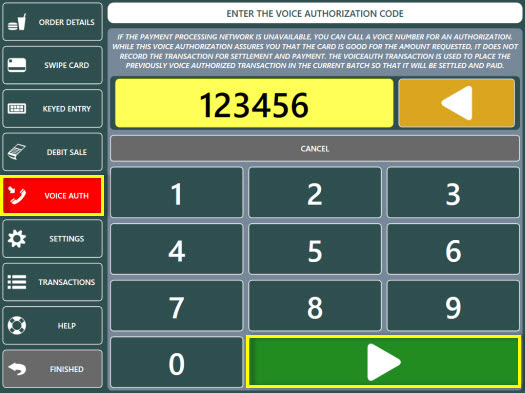

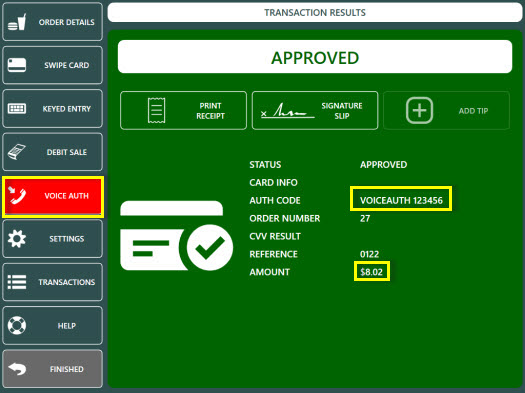

The VOICE AUTH transaction type is used to process a transaction for which a voice authorization code was previously obtained. If the payment processing network is unavailable, the merchant can call a voice number for an authorization. While this voice authorization assures the merchant that the card is good for the amount requested, it does not record the transaction for settlement and payment to the merchant’s bank account. The VOICE AUTH transaction is used to place the previously voice authorized transaction in the current batch so that it will be settled and paid to the merchant.

A voice authorization is typically required when a SALE transaction is declined with the message CALL CENTER with a red background. Call the toll free number provided by the payment processor to obtain a numeric voice authorization code.

If the credit card screen is still open, press the VOICE AUTH button. If the credit card screen is not open, select the order on the recall list and press the CREDIT button. Click cancel on the card swipe prompt and press the VOICE AUTH button. Enter the numeric voice authorization code received from the call center.

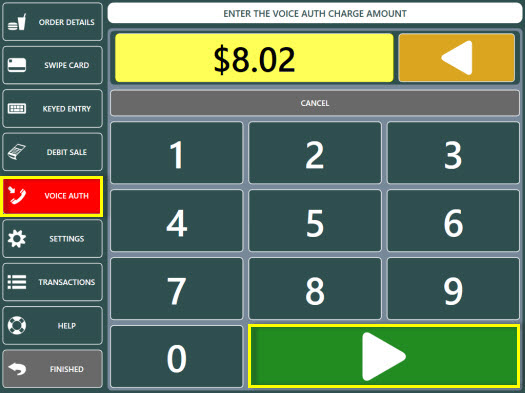

Enter the sale amount and press the green button to process the transaction.

An approved VOICE AUTH transaction is displayed with a green background. The auth code and authorized amount are included in the results for confirmation. An approved VOICE AUTH transaction is added to the batch and will be settled at the next scheduled batch settlement.

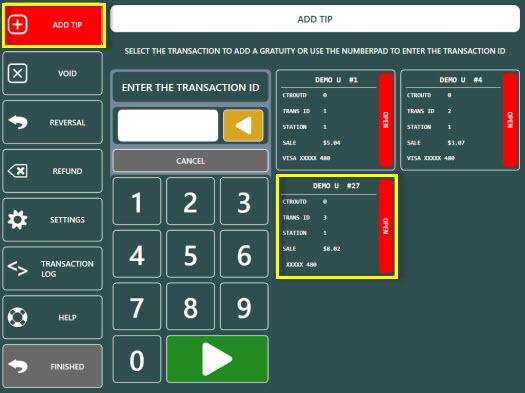

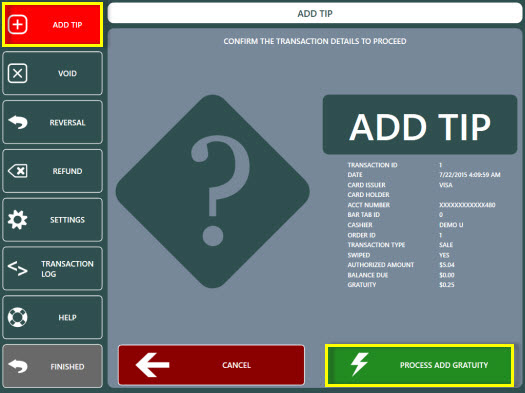

The ADD TIP transaction type is used to add or adjust the tip amount on a previously processed SALE transaction. An incorrect tip amount can be corrected by running an additional ADD TIP transaction for the correct amount.

Login to the POS and press the CREDIT CARDS button on the bottom right to display a list of eligible transactions. Select the transaction or enter the transaction id (as shown on the signature slip) using the on-screen number pad.

Review the transaction information shown on the confirmation screen and press the green button to process the transaction.

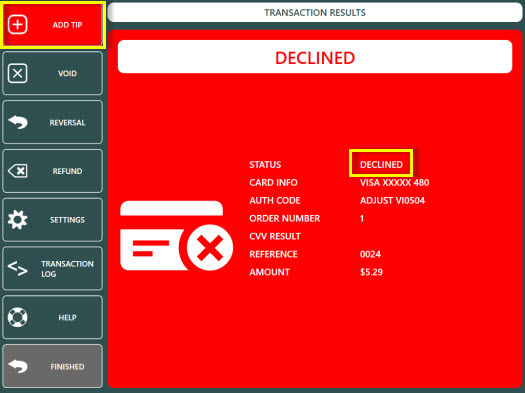

A successful ADD TIP transaction is displayed with a green background. An unsuccessful ADD TIP transaction is displayed with a red background. In the example below, the ADD TIP transaction is declined because the SALE transaction was previously voided.

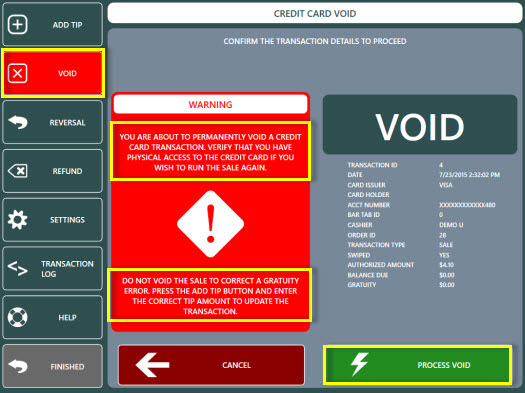

The VOID transaction type is used to void a previously completed sale (payment) transaction in the current batch on a credit card (VISA, MasterCard, American Express, Discover, Carte Blanche, Diner’s Club, JCB or other supported card type).

|

Warning: A credit card void is permanent and cannot be reversed Do not void a credit card transaction if you do not have physical access to the customer's card or the account number, expiration date and CVV. |

Login to the POS and press the CREDIT CARDS button on the bottom right to display a list of eligible transactions. Press the VOID button and select the transaction or enter the transaction id (as shown on the signature slip) using the on-screen number pad. Review the transaction information shown on the confirmation screen and press the green button to process the VOID transaction.

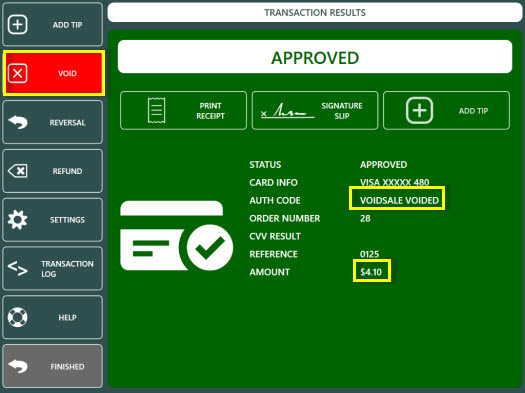

A successful VOID transaction is displayed with a green background. An unsuccessful VOID transaction is displayed with a red background.

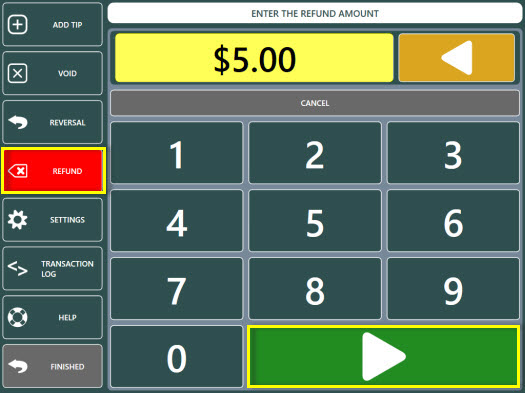

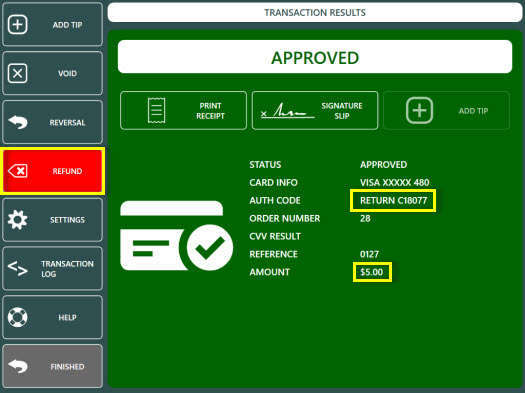

The REFUND transaction type is used to process a return (Mercury Pay and NETePay refer to a refund as a RETURN transaction) to a credit card (VISA, MasterCard, American Express, Discover, Carte Blanche, Diner’s Club, JCB or other supported card type).

To start a refund transaction, recall the order and press the CREDIT button. Click Cancel on the card swipe prompt and press the REFUND button to enter the refund amount using the on-screen number pad.

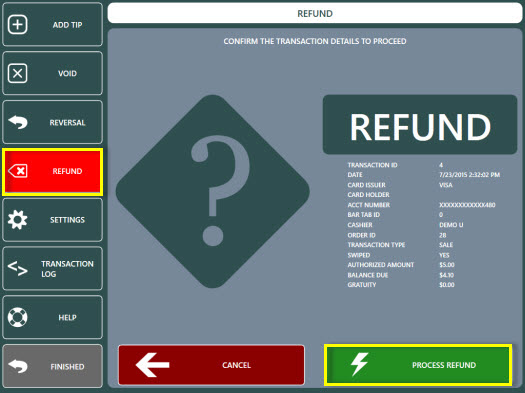

Review the transaction information shown on the confirmation screen and press the green button to process the REFUND transaction.

A successful REFUND transaction is displayed with a green background. An unsuccessful REFUND transaction is displayed with a red background.

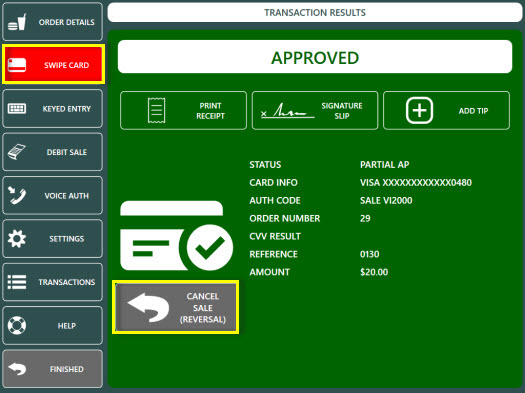

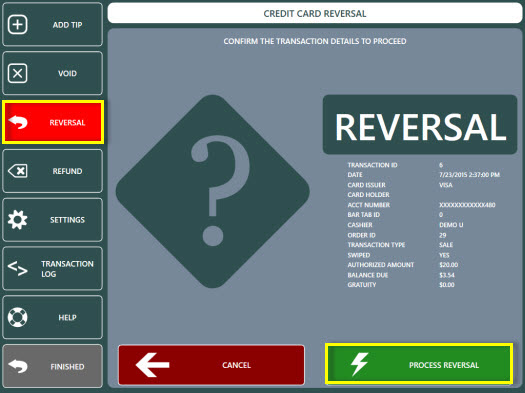

The REVERSAL transaction type is used to void a previous SALE transaction. REVERSAL differs from the VOID transaction type in that the funds are returned to the customer's card immediately upon a successful REVERSAL transaction. A VOID trnsaction will return the funds to the customer's card within 3-7 days. The REVERSAL transaction is available only for SALE transactions in the current batch.

|

Warning: A credit card void is permanent and cannot be reversed Do not void a credit card transaction if you do not have physical access to the customer's card or the account number, expiration date and CVV. |

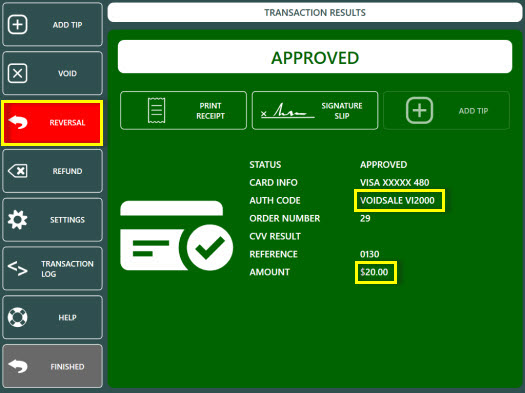

A typical scenario for a REVERSAL transaction is when a prepaid card is authorized for a partial amount of the balance due and the customer wishes to use a different card. A successful SALE transaction displays the REVERSAL button on the results screen. If the credit card screen is not open, login to the POS and press the CREDIT CARDS button on the bottom right to display a list of eligible transactions. Press the REVERSAL button at the left and select the transaction or enter the transaction id (as shown on the signature slip) using the on-screen number pad.

Review the transaction information shown on the confirmation screen and press the green button to process the REVERSAL transaction.

A successful REVERSAL transaction is displayed with a green background. An unsuccessful REVERSAL transaction is displayed with a red background.